Socially responsible marketing: How to strike the right balance

In Great Britain, companies in the gambling industry face unique challenges when it comes to marketing and advertising. Gambling operators and affiliates alike are expected to keep abreast of complex and diverse requirements set by the Gambling Commission, the Advertising Standards Authority, the Betting and Gaming Council, the Information Commissioner’s Office and the Competition and Markets Authority – to name just a key few – to ensure British brands are marketed in a compliant and socially responsible manner.

To assist our regular readers, we outline below some of the key changes to British rules and regulations that will either imminently, or have recently, impacted the way in which companies undertake gambling marketing – including some that can occasionally, be overlooked.

Why is compliant marketing so important?

For companies in the gambling industry, striking the right balance between promoting brand/s, complying with regulatory obligations and protecting customers is key. Not just for compliance reasons (although this is – of course – paramount): socially responsible marketing also enhances reputation, differentiates a company from its competitors in a crowded marketplace, and helps to build consumer trust. However, achieving such a delicate balance is no mean feat because the ecosystem in which gambling companies operate is rapidly evolving.

How do you keep abreast of changing requirements? If you undertake marketing for a gambling brand that holds an operating licence issued by the Gambling Commission, it is a good idea to sign up for regulatory newsletters, including those published by the following organisations:

- The Gambling Commission’s eBulletin, which includes information about consultations, recent regulatory enforcement action, changing requirements and other compliance matters: https://www.gamblingcommission.gov.uk/e-bulletin

- The Advertising Standards Authority (“ASA”)’s newsletters – five are available but in our opinion, the most useful are the ASA rulings (which are weekly ASA adjudication alerts), the insight newsletter (which provides advice on advertising compliance) and the update newsletter (which includes details of public consultations): https://www.asa.org.uk/newsletter.html

- The Betting and Gaming Council (“BGC”)’s newsletter, which includes news from the betting and gaming industry body, including in relation to the codes of conduct that apply to its members: https://bettingandgamingcouncil.com/ (click “BGC News signup” at the top of the page)

- The Information Commissioner’s Office (“ICO”)’s E-newsletter (which provides updates on the latest developments in data protection laws) and Action We have Taken eNewsletter (which includes news on the action the ICO has taken against nuisance marketers, the trends they are seeing, and areas that will be investigated in the future): https://ico.org.uk/about-the-ico/media-centre/e-newsletter/

By subscribing to the above newsletters and other third party sources, such as this blog and gambling industry news articles, you will be amongst the first to be informed of regulatory changes that could impact the way that you undertake future marketing. Key changes are often also publicly consulted upon before they take effect. By signing up to regulatory newsletters and learning about future consultations, you may also have the opportunity to voice your opinion and shape future rules and regulations, before they come into effect.

If you are an affiliate, it is also important to remember that the brands you are marketing may have their own bespoke requirements. If so, these will typically be set out in your contract, or in a brand guidelines document that will be updated by the operator from time to time. Although there will of course, be many similarities between different operators’ requirements, each one will have its own approach and risk rationale when it comes to advertising – so it is important to check your contract, or get in touch with your affiliate manager if you want to find out more.

What changes are on the horizon?

We set out below some of the key changes that will impact gambling advertising and marketing in Great Britain in the near future.

- 1 May 2025: Changes to direct marketing preferences

The Gambling Commission’s requirements regarding gambling marketing and advertising are set out in Part 5 of the Code of Practice provisions in the Licence Conditions and Codes of Practice.

From 1 May 2025, a new Social Responsibility Code Provision (“SRCP”) 5.1.12 will come into effect, which will read as follows:

-

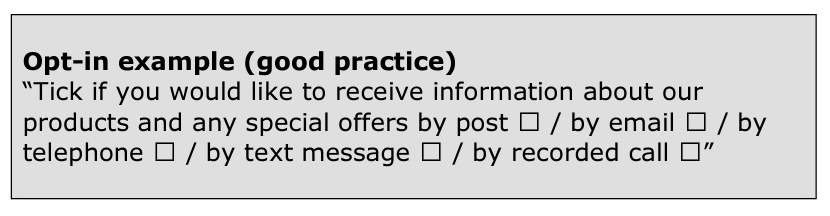

- “Licensees must provide customers with options to opt-in to direct marketing on a per product and per channel basis. The options must cover all products and channels provided by the licensee and be set to opt-out by default. These options must be offered as part of the registration process and be updateable should customers change their preference. This requirement applies to all new and existing customers.

- Channel options must include phone call, email and text messages (SMS) as applicable.

- Product options must include betting, casino, bingo, as applicable. Operators must make clear to customers which products they offer are covered under relevant categories.

- Where an operator seeks an additional step for customers to confirm their chosen marketing preferences, the structure and wording of that step must be presented in a manner which only asks for confirmation to progress those choices with one click to proceed. There must be no encouragement or option to change selection; only the option to accept or decline their selection.

- Customers must not receive direct marketing that contravenes their channel or product preferences.

- Existing customers who have not already opted out of marketing must be asked at their first log-in after commencement of this provision to confirm their marketing preferences if they have not done so already. Existing preferences can be copied over providing they match the format of this requirement.”

In essence, SRCP 5.1.12 is being introduced to ensure that from 1 May 2025, remote B2C gambling operators give their customers more granular options regarding direct marketing preferences.

While this change will certainly empower customers with greater control over the types of marketing they receive, the changes are controversial as they will essentially prevent operators from the relying upon the ‘soft opt in’ under the Privacy and Electronic Communications (EC Directive) Regulations 2003 (“PECR”): a commonly accepted exception to the general prohibition on sending unsolicited direct marketing to consumers, that permits businesses to market similar products and services to existing customers unless they have expressly opted out. The net effect being that, from 1 May 2025, gambling will stand alone in being the only industry that does not benefit from this business-friendly exception and many operators and affiliates will need to obtain fresh consent from, in some cases, the majority of customers to whom they are currently lawfully marketing.

We strongly recommend that operators and affiliates prepare for this seismic shift by:

(a) reviewing marketing lists now to identify the customers to whom they will no longer be able to send marketing from 1 May 2025. For example, because they are marketing to those customers in reliance upon the soft opt in under PECR or because the express consent they previous obtained was not sufficiently granular;

(b) seeking to obtain fresh consent from these individuals, that is compliant with the new requirements, as soon as possible; and

(c) ensuring their systems and processes for preventing marketing being sent to customers that do not grant express consent are robust and do not cause them to breach SRCP 5.1.12 once it comes into force.

For further discussion on the proposed changes please see our blog: White Paper Series: Direct marketing and cross-selling in the crossfire.

- TBC: Changes following the Gambling Commission’s Autumn Consultation

As at the time of writing, the Gambling Commission’s response to its proposals regarding socially responsible incentives in its Autumn Consultation is still pending. This is despite the fact that the response to the other proposals in that consultation was published on 4 February 2025 (for more information, please see our blog: White Paper Series: New rules on customer led tools, customer funds and statutory levy), which confirmed:

“We aim to publish our response on Socially responsible incentives by the end of March.”

While future changes regarding socially responsible incentives are not yet set in stone, we anticipate that significant changes will come to pass. Licensees should anticipate:

- new rules restricting (or evening banning) wagering requirements on free bets and bonuses; and

- a ban on the mixing of product types within incentives. For example: giving free spins to sports bettors; or free bets to bingo players.

Although the devil will of course, be in the detail – the biggest (and smartest) players are already taking steps to prepare. For example, by permitting internal marketing and compliance experts opportunities to examine current marketing techniques together; identify any practices that may not comply with the Gambling Commission’s future rules; take external advice, where appropriate; and brainstorm novel techniques that may have more longevity in terms of helping the business to acquire new customers, increase their engagement with products (in a socially responsible way), and prevent customer attrition (otherwise known as ‘churn’) in the future.

Which marketing obligations can sometimes be overlooked?

As well as scanning the regulatory horizon for future change, marketing teams should ensure they are alive to recent reforms to direct marketing and advertising rules that, in our experience, can occasionally be overlooked.

- Social Responsibility Code Provision (“SRCP”) 3.4.3: Remote Customer Interaction

Although most remote licensee are acutely aware of SRCP 3.4.3 and the GBGC’s associated customer interaction guidance for the remote sector (the “Guidance”), the obligation for remote licensees to stop sending marketing to customers that are displaying strong indicators as harm (as defined by their systems and processes, having taken the Guidance into account) is one that can still in our experience, be overlooked.

The requirement in question means that remote operators must ensure that when their customers are, in their view, displaying strong indicators of harm, they must promptly cease sending the customer direct marketing communications. In other words, licensees must ensure that:

(i) they have systems in process in place to identify indicators of harm;

(ii) assess when those indicators of harm are strong – either on their own or when taken together; and

(iii) there are adequate and effective communication channels between a licensee’s responsible gambling and marketing teams, such that marketing is stopped at the appropriate juncture.

- Licence Condition (“LC”) 7.1: General Fair and Open Obligations and Related Obligations

Existing regulations like LC 7.1..1 (fair and transparent terms and practices), Ordinary Code Provision (“OCP”) 5.1.1 (rewards and bonuses – SR code), and 5.1.2 (proportionate rewards) of the LCCP stress the need for fairness and transparency in marketing offers.

This means that companies must ensure that significant terms are clearly presented in advertisements; full terms and conditions are easily accessible; and do not contain any unfair provisions. In our experience, this is an area of focus for the Gambling Commission during a compliance assessment, which may therefore expose licensees to enforcement action. We therefore suggest that licensees proactively review their general and offer-specific terms and conditions against the LCCP requirements.

- CAP/BCAP Codes and the BGC’s Gambling Industry Code for Socially Responsible Advertising (the “Industry Code”)

The UK Code of Non-broadcast Advertising and Direct & Promotional Marketing (the “CAP Code”), for those undertaking television marketing, the UK Code of Broadcast Advertising (the “BCAP Code”), and the BGC’s Gambling Advertising Code, are essential reading for marketing teams. These codes outline how and when to target marketing efforts and are entrenched in the LCCP under OCP 7.1.1 (compliance with advertising codes), which states:

-

- All marketing of gambling products and services must be undertaken in a socially responsible manner.

- In particular, Licensees must comply with the advertising codes of practice issued by the Committee of Advertising Practice (CAP) and the Broadcast Committee of Advertising Practice (BCAP) as applicable. For media not explicitly covered, licensees should have regard to the principles included in these codes of practice as if they were explicitly covered.

Common pitfalls, such as inadequate age-gating on third party platforms; use of brand ambassadors that strongly appeal to under 18s and/or not including significant terms and conditions on a promotion, can lead to regulatory action and reputational harm.

- SRCP 1.1.2: Responsibility for Third Parties

Although we are confident that most licensees are acutely aware of SRCP 1.1.2 (responsibility for third parties – all licences), which states as follows; in our experience it is one of the requirements of the LCCP that is commonly breached. Sometimes by a third party that is carrying out a regulated activity on behalf of a licensed operator, but also sometimes by the licensee themselves – in cases where they have entered into an agreement that does that not require the third party to conduct themselves as if they were themselves bound by the LCCP and/or that cannot be terminated in accordance with SRCP 1.1.2.

- Licensees are responsible for the actions of third parties with whom they contract for the provision of any aspect of the licensee’s business related to the licensed activities.

- Licensees must ensure that the terms on which they contract with such third parties:

a. require the third party to conduct themselves in so far as they carry out activities on behalf of the licensee as if they were bound by the same licence conditions and subject to the same codes of practice as the licensee

b. oblige the third party to provide such information to the licensee as they may reasonably require in order to enable the licensee to comply with their information reporting and other obligations to the Commission

c. enable the licensee, subject to compliance with any dispute resolution provisions of such contract, to terminate the third party’s contract promptly if, in the licensee’s reasonable opinion, the third party is in breach of contract (including in particular terms included pursuant to this code provision) or has otherwise acted in a manner which is inconsistent with the licensing objectives, including for affiliates where they have breached a relevant advertising code of practice.

In addition to ensuring that commercial agreements are compliant with the above provision, we also recommend that licensees conduct and refresh due diligence, including PEP (politically exposed person) and sanction checks, on affiliates and other partners.

Establishing detailed brand guidelines, requiring approval for new marketing copy, and conducting regular audits can also help to mitigate the risk of vicarious non-compliance, which could threaten a brand’s integrity.

Our top tips for compliance

While a changing regulatory environment can present challenges, there are strategies that you can put in place to assist your business to stay compliant:

- Communication: Fostering strong communication channels between marketing and compliance teams is essential. In larger organisations, it is equally important for brands to collaborate effectively, ensuring that all marketing strategies align with compliance standards across the wider business.

- Induction and Refresher Training: Arrange comprehensive induction and refresher training sessions for marketing teams, particularly when regulatory changes are imminent. Harris Hagan can provide tailored training, along with the creation and updating of internal checklists and guides to ensure that staff are well-informed about current and forthcoming requirements.

- A/B Test New Methods: Consider A/B testing new consent and marketing methods in anticipation of forthcoming changes to marketing preferences and socially responsible incentives. This proactive approach can help identify effective strategies that comply with upcoming regulations.

- Involve Compliance Teams: When devising new campaigns or marketing new products, involve compliance teams early in the process. Having legal experts review marketing copy, especially for innovative or unconventional products, is critical. Keeping thorough records of these reviews can provide additional protection.

- Implement Technical Solutions: Ensure that robust technical systems are in place to suppress marketing communications where appropriate, such as in cases of strong indicators of harm have been identified, a customer has self-excluded, or when consent is withdrawn. Regularly test systems to ensure there is no ‘single point of failure’ in marketing controls. This will, in in turn support you to demonstrate that ‘reasonable steps’ have been taken, if there is any subsequent oversight.

- Distinguish Between Marketing and Service Communications: It’s important to understand the distinction between marketing communications and service communications. These two types of communication should not be mixed to avoid confusing customers and to maintain regulatory compliance.

- Contingency Plans: If a marketing mistake occurs, having policies and procedures in place to limit potential damage is essential. Companies should notify regulators as required and take steps to protect their brand reputation. After addressing the incident, take the time to analyse what went wrong and implement measures to reduce the risk of recurrence.

Conclusion

Striking the right balance between promoting your brand and protecting customers in the gambling industry is not just a matter of compliance; it’s a smart business strategy.

By: (1) embracing socially responsible marketing practices; and (2) taking proactive steps now, gambling companies can ensure their marketing efforts align with both their brand values and the welfare of their customers, creating a win-win scenario for all stakeholders involved.

Please get in touch with us if you have any questions about direct marketing, are interested in receiving our handy gambling advertising guide in Great Britain, would like assistance reviewing your terms and conditions and/or ads for compliance with British gambling regulatory requirements, or are looking to arrange training for marketing staff, compliance teams and/or PML holders in your gambling business.