Gambling Survey of Great Britain: Publication of first annual report

After more than 3 years of development and significant industry scrutiny, the Gambling Commission published the first Gambling Survey for Great Britain (“GSGB”) Annual Report on 25 July 2024 (“GSGB Annual Report”).

In a press release announcing the publication, the Gambling Commission stated that this first edition features responses from 9,804 people “but will increase to around 20,000 by next year.” The Gambling Commission goes on to state that the GSGB Annual Report provides greater insight into attitudes and gambling behaviours:

“presenting a fuller picture, illuminating participation rates, the type of gambling activities participated in, experiences and reasons for gambling, and the consequences that gambling can have on individuals and others close to them.”

We have previously explained the GSGB’s structure and purpose in our blog Gambling Survey of Great Britain: Gambling Commission’s new approach to collecting gambling participation and prevalence data.

We now turn to the key facts outlined in the GSGB Annual Report and consider the information published by the Gambling Commission to support the GSGB.

Key Facts

The GSGB Annual Report highlights key facts from the data collected from adults aged 18 years and older living in Great Britain, summarised below.

Participation

- 48% of GSGB participants participated in any form of gambling in the past four weeks. This figure dropped to 27% when those who only participated in lottery draws were excluded.

- GSGB participants were more likely to gamble online (37%) than in-person (29%), however this difference was largely accounted for by people who purchase lottery tickets online. Excluding those individuals, GSGB participants were more likely to gamble in-person (18%) than online (15%).

- The most commonly reported gambling activities were the National Lottery (31%), purchasing tickets for other charity lotteries (16%) and buying scratchcards (13%). The average number of activities for those who had participated in gambling in the past 4 weeks was 2.2 activities during that period.

Experiences of and reasons for gambling

- 41% of GSGB participants who had gambled in the past 12 months rated the last time they gambled with a positive score (6 or above on a scale of 0 to 10), 37% expressed they neither loved nor hated it (score of 5) and 21% gave a negative score. When participating in lottery draws was excluded the pattern displayed a slightly higher proportion of positive scores, with 50% positive, 31% neutral and 19% negative.

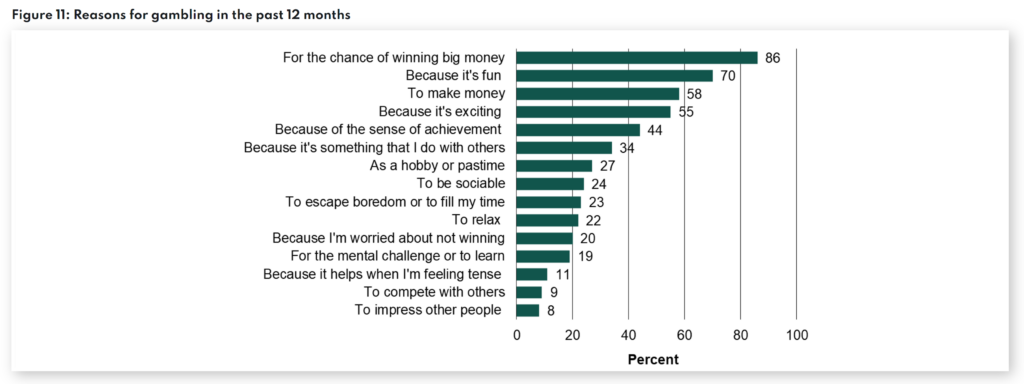

- The most common reasons that GSGB participants gambled were for the chance of winning big money (86%), because gambling is fun (70%), to make money (58%) and because it was exciting (55%).

Figure 11 of the GSGB Annual Report displays the full list of reasons for gambling in the past 12 months surveyed, represented below where the percentages comprise individuals who reported ‘sometimes’, ‘often’ or ‘always’ as a reason for gambling for each statement.

Notably, GSGB participants were also surveyed on the types of leisure activities in which they participated in the past 4 weeks. The vast majority of participants indicated they spent time with friends and family (98%), watched TV (95%) and listened to music (91%), with many also reported shopping (80%), eating out at restaurants (73%), participating in sports or exercise (64%), doing DIY or gardening (61%) or going to pubs, bars or clubs (50%).

Consequences from gambling

- GSGB participants who had bet on non-sports events in person were over 9 times more likely than average to have a score of 8 or higher on the Problem Gambling Severity Index (“PGSI”), which represents problem gambling by which a person will have “experienced adverse consequences from their gambling and may have lost control of their behaviour.”

- GSGB participants who had gambled on online slots were over 6 times more likely than average to have a PGSI score of 8 or higher.

- 41.4% of GSGB participants with a PGSI score of 8 or higher reported experiencing at least one of the severe adverse consequences asked about.

The severe adverse consequences surveyed required ‘yes’ or ‘no’ responses and consisted of: (1) losing something of significant financial value because of gambling; (2) relationship with spouse or partner or family member breaking down because of gambling; (3) experiencing violence or abuse because of gambling; and (4) committing a crime to fund gambling or pay gambling debts. Overall, 2.8% of GSGB participants who had gambled in the past 12 months reported experiencing at least one severe consequence.

The Gambling Commission also highlights that the GSGB is the first time that it has collected data on the consequences of someone else gambling. 47.9% of GSGB participants reported that someone close to them gambled. The most reported severe consequence of someone else gambling was the breakdown of a relationship with a spouse, partner or family member (3.5%).

Gambling Commission Guidance

To accompany the GSGB Annual Report, the Gambling Commission released Guidance on using statistics from the Gambling Survey for Great Britain (“GSGB Guidance”). The purpose of the GSGB Guidance is to ensure the GSGB data is reported correctly, with the Gambling Commission reiterating that these official statistics are new and are collected using a different methodology than previous official statistics.

The GSGB Guidance therefore lists the purposes for which the GSGB can and can’t be used, as well as where it can be used with some caution, in relation to the data on: (1) gambling participation; and (2) the consequences of gambling within the GSGB Annual Report. Of note, the GSGB can be used:

- to look at patterns within the data amongst different demographic groups;

- to assess future trends and changes in gambling participation and consequences of gambling, measuring changes against the 2024 baseline; and

- to describe the range of consequences that someone may experience as a result of their own gambling and as a result of someone else’s gambling.

The GSGB can be used with some caution “until further work is completed”:

- to provide estimates of gambling participation amongst adults in Great Britain;

- to provide estimates of PGSI scores amongst adults in Great Britain; and

- to provide estimates of the prevalence of consequences of gambling amongst adults in Great Britain.

The GSGB should not be used:

- to provide direct comparisons with results from prior gambling or health surveys;

- as a measure of addiction to gambling; and

- to calculate an overall rate of gambling-related harm in Great Britain.

The GSGB Guidance also addresses the misuse of GSGB statistics. The Gambling Commission encourages the use of the statistics to support the understanding of important issues relating to gambling, but expects that “anyone using official statistics should present the data accurately and in accordance with the guidelines presented .”

Reiterating the message issued by Andrew Rhodes, Chief Executive Officer of the Gambling Commission, in his open letter to the industry in August 2023, if an individual or organisation is found to be using the GSGB inaccurately, the Gambling Commission “may contact them and request that they correct the statistics.” In “severe cases or continued misuse of official statistics”, the Gambling Commission may refer the individual or organisation to the Office of Statistics Regulation (“OSR”).

Whilst the Gambling Commission’s expectations for the use of the GSGB statistics have been made clear, it has not defined what it considers a “severe” case of misuse. However, the Gambling Commission’s Executive Director, Tim Miller, stated during the VIXIO Regulatory Intelligence webinar on 23 July 2024 that the Gambling Commission will challenge any misuse “in an appropriate way” such as by referral to the OSR, which has included “some examples in recent months where has taken those sorts of approaches.” We therefore encourage the industry to ensure its adherence with the GSGB Guidance.

Strengths and Limitations

The Gambling Commission has acknowledged that measuring adverse consequences from gambling in surveys is a challenging task, and cites Professor Patrick Sturgis’ statement in his Assessment of the Gambling Survey for Great Britain (GSGB):

“Given the widespread negative social norms around gambling, particularly harmful gambling, obtaining representative samples and accurate response data is at the more difficult end of what survey researchers seek to measure in general populations.”

Furthermore, the Gambling Commission states in its press release that Professor Sturgis warned that estimates of problem gambling rates should be used with caution due to the risk that the new methodology “substantially overstates the true level of gambling and gambling harm in the population.” The Gambling Commission updated its Gambling Survey for Great Britain – technical report to include a list of the GSGB’s strengths and limitations and caveats for the interpretation of PGSI score estimates produced in the GSGB.

Having set out these strengths and limitations, its expectations for the correct use of the GSGB statistics and the consequences for misuse, the Gambling Commission has seemingly attempted to temper the industry’s concerns about the accuracy and reliability of the new official statistics. During the VIXIO webinar, Miller stated that the Gambling Commission has listened to “recognised experts in data and statistics in developing the GSGB methodology”, as well as the GSGB Guidance. Acknowledging that all methodologies have limitations, Miller stated that a key difference is that the Gambling Commission is “very open and transparent about what the GSGB’s current limitations are”.

Miller defended criticism of the GSGB’s methodology and noted that the Health Survey for England is not without significant issues, having presented an “inflexibility” to update questions for relevance and an inconsistent method for the Gambling Commission to collect data on gambling activity. Miller confirmed the Gambling Commission continues to invest “a significant amount” into the GSGB methodology and is “confident that as to develop , this will become the new gold standard”.

Next Steps

The Gambling Commission explains that in a typical year, there will be four wave-specific publications from the GSGB, plus an annual report. In his blog accompanying the GSGB Annual Report, Ben Haden, Director of Research and Statistics at the Gambling Commission, explains that the GSGB removes its over-reliance on the PGSI as a “proxy for harms” and, even at a headline level, “a more general analysis of wider consequences and behavioural symptoms will give a far more nuanced picture than ever before.” Haden also states that two “in-depth reports” will be released before Christmas as the Gambling Commission commences its deeper analysis of the GSGB statistics.

Where the Gambling Commission acknowledges that the GSGB may overstate the true level of gambling and gambling harm in Great Britain, the release of the GSGB Annual Report will not calm industry concerns about the accuracy of these official statistics. Indeed, we share this concern where the proposals outlined in the White Paper may be evaluated, and potentially derailed, by these statistics. The Gambling Commission promised a “gold standard population survey for the whole of Great Britain”, in its effort to improve the quality, robustness and timeliness of official statistics on gambling behaviour in Great Britain: this is no doubt a challenging task. Therefore, noting Miller’s confidence in the GSGB as the Gambling Commission continues to develop the methodology, we will continue to follow the GSGB closely with the hope that the Gambling Commission moves closer to its aim.

Please get in contact with us if you have any questions about the GSGB Annual Report, the GSGB Guidance or how these statistics may impact your business.