White Paper Series: Gambling sponsorship of sport – a modern endemic or just the weapon du jour in political warfare?

Twenty years after the first partnership between a Premier League football team and a gambling company, the Premier League clubs released a statement on 13 April 2023 confirming that they had “collectively agreed to withdraw gambling sponsorship from the front of clubs’ matchday shirts…” with the aim to reduce the prominence of gambling sponsorship in the Premier League from the end of the 2025/26 season (the “Voluntary Ban”).

Two weeks later, the UK Government released its White Paper High stakes: gambling reform for the digital age, in which the Government commended the Voluntary Ban and also endorsed the creation of a new cross-sport gambling sponsorship code (the “Sponsorship Code of Conduct”) to ensure sponsorship deals are socially responsible.

Critically, however, the White Paper did not – despite calls to the contrary from anti-gambling campaigners – ban gambling sponsorship of sports. For many, this raised eyebrows and prompted the question: did the Premier League and the Government go far enough?

Some say not. Indeed, in the most recent survey by the Football Supporters Association (the “FSA”), 73.1% (nearly three quarters) of respondents agreed with the statement:

“I am concerned about the amount of gambling advertising and sponsorship in football.”

In this White Paper Series blog, we delve deeper into the Voluntary Ban and the Sponsorship Code of Conduct and consider the effectiveness of these methods of self-regulation.

1. Background

The liberalisation of gambling advertising was one of the major changes introduced by the Gambling Act 2005 (the “2005 Act”). Before the 2005 Act, only bingo and lotteries were permitted to advertise on television. Since then the landscape has shifted significantly and gambling marketing, including by means of sponsorship, has become both highly visible and lucrative. Gambling brands provided 12% of sports sponsorship revenue according to a 2019 estimate.

Aside from horse racing and greyhound racing, which have integral links to betting, gambling sponsors are most strongly present in top-tier football, where 8 out of 20 Premier League teams in the 2022/23 season had a front-of-shirt gambling sponsor and all teams had an ‘official betting partner’. In smaller sports such as darts and snooker, a substantial amount of sponsorship revenue also comes from gambling operators.

Potentially as a result of its visibility and the associated revenue, the questions on sponsorship in the call for evidence published by the Government in preparation for its production of the White Paper attracted a high number of responses, with strongly polarised views. Industry stakeholders (as well as representatives of sectors that benefit from gambling advertising, such as broadcasters and sports governing bodies) broadly took the view that the current regulatory regime was fit for purpose. These respondents also emphasised the contributions that gambling revenue makes to other sectors.

In contrast, many other respondents (particularly across the health, charity and academic sectors) argued that gambling advertising was in need of significant reform, with several stakeholders in this group advocating a complete sponsorship ban. Many of these responses expressed concern regarding the link between sports and gambling and a common theme was the need for a ‘precautionary’ approach to the regulation of advertising, arguing that the absence of evidence of harm must not be treated as evidence of an absence of harm.

In the end, the Government concluded that although the limited high‑quality evidence they received on sport sponsorship indicated that it does have a level of impact on gambling behaviour, this was not as marked as for other forms of marketing (such as seeing gambling advertising online or receiving direct marketing) and it was these latter advertising mediums that should be subject to reform following consultation – and we will discuss the proposed reforms in these areas in a later blog.

Returning to sports sponsorship, the White Paper commended the steps taken voluntarily by the industry and other regulators to date, including the Voluntary Ban, sports governing bodies’ agreement to adopt the Sponsorship Code of Conduct and the introduction of the strong appeal test by the Advertising Standards Authority (the “ASA”); as well as the ASA’s recent high profile enforcement action in relation to the strong appeal test (which we have previously discussed) – but did not recommend the introduction of any more draconian measures to curb the prevalence of gambling sponsorship of sports.

The Voluntary Ban and the Sponsorship Code of Conduct appear therefore to have been well-timed pre-emptive strikes for self-regulation, but will they go far enough?

2. Voluntary Ban – the toothless tiger?

It is without doubt that the Voluntary Ban is a positive step in the right direction by the Premier League. The reduction of children’s exposure to gambling by way of sponsorship, advertising or otherwise is, as the Secretary of State Lucy Frazer noted in her speech to Parliament unveiling the White Paper, a key motivation of both sides of Parliament and the industry as a whole:

“We must do more, which is why we are taking steps to make gambling illegal, in many forms, for under-18s. I welcome the Premier League’s announcement on banning gambling advertising from the front of shirts. Footballers are role models for our children, and we do not want young people to advertise gambling on the front of their shirts…”

The Government’s decision not to recommend further measures to reduce gambling sponsorship of sports (and specifically, football) has not, however, come without scepticism. During the unveiling of the White Paper, several members of Parliament questioned the effectiveness of the Voluntary Ban and criticised the Government’s decision not to take further action. Below we consider some of these arguments and ask whether the Voluntary Ban has actually gone far enough.

First and foremost, it is undeniable that the Voluntary Ban will, once it is implemented, be an important step in reducing the prevalence of gambling advertising to children, for example in football sticker albums that are directly marketed to children. However, the ban does not come into force until the end of the 2025/26 season (theoretically permitting three more football seasons and associated sticker collections with front of shirt sponsorship, at the time of writing) and even when it does come into force, the Voluntary Ban does not extend to the backs of matchday shirts nor other parts of the playing kit. Indeed, the sceptics amongst us will probably expect to see a sea of sleeves adorned with gambling logos in 2026/27.

The second point to note is that shirts (front or otherwise) really are the tip of the iceberg of gambling sponsorship. In the absence of significant reform (for example, in the Sponsorship Code of Conduct, discussed below), we can expect to continue to see gambling sponsorship on pitchside hoardings and structures within football stadiums that are visible to the crowd and/or those watching the match broadcast on television or online.

Thirdly, the Voluntary Ban applies to the Premier League only – lower divisions in the English Football League will be free to continue to accept sponsorship, including on the fronts of shirts – from gambling operators if they choose.

The final argument raised during the Parliamentary debate was that, without a firm stance from the Government, the Premier League could change its tune and reduce the extent of the Voluntary Ban or reverse it entirely. This is of course, an inherent risk of advocating reform by means of self-regulation by an industry – the industry retains control but this risk is countered by the fact that self-regulation is invariably the quickest method to achieve change. During the debate, the Government countered the possibility that the Premier League would subsequently change its position with the reassurance that it “made position very clear to the Premier League” regarding the action it ought to be taking, and it will take any further steps as necessary in the event of further research into the issue.

3. Make the code, not war

In comparison, the Sponsorship Code of Conduct remained largely outside the focus of the Parliamentary debate surrounding the White Paper’s publication.

This may be because the White Paper is rather vague on the scope of the Sponsorship Code of Conduct. Although it recommends that the new code will be common to “all sports” apart from greyhound and horseracing, we do not yet know what this will mean in practice. Will motorsports or esports be included, for example? Instead, the White Paper simply states that:

“Sports bodies need to ensure a responsible approach is taken to gambling sponsorship through the adoption of a Code of Conduct which will be common to all sports. For individual sports we believe that sports governing bodies are best placed to drive up standards in gambling sponsorship, recognising their specific context and responsibility to their fans. We welcome the work that is underway through sports governing bodies to develop a gambling sponsorship Code of Conduct, and will continue to support its development and implementation across the whole sporting sector…

…The measures included in a sponsorship Code need to be robust enough to provide meaningful improvements in the social responsibility of gambling sponsorships, while giving flexibility to accommodate the material differences between sports.”

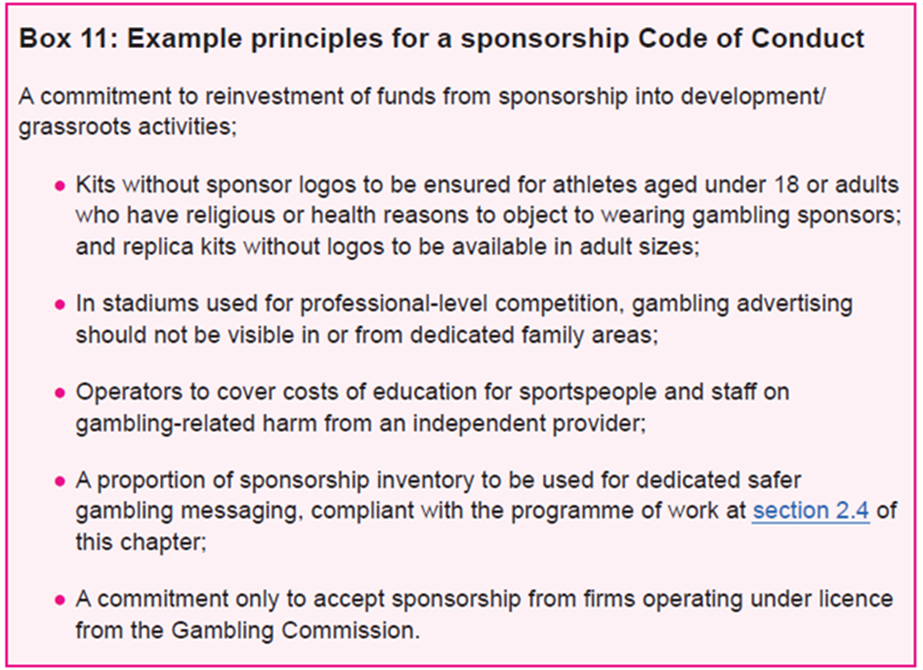

The Government goes on to set out some possible principles to be included in the Sponsorship Code of Conduct:

Until we see the draft Sponsorship Code of Conduct, we will not know what impact, if any, it will have on current sponsorship arrangements. Certainly, a couple of the principles suggested in the White Paper appear to go no further than current requirements. By way of example:

(a) it is an offence under the 2005 Act to advertise unlawful gambling, including by means of sponsorship arrangements, and this offence carries a maximum sentence of imprisonment for a term not exceeding 51 weeks and a maximum fine of £5,000 (at the time of writing). If the possibility of committing a criminal offence is not a deterrent against accepting sponsorship from a gambling operator that is not appropriately authorised by a Gambling Commission licence, a commitment to a sports governing body under a voluntary Code of Conduct is unlikely to carry much additional weight; and

(b) operators are already required to follow relevant industry codes on advertising, notably the Industry Code for Socially Responsible Advertising, which provides that:

“advertising of adult-only gambling product suppliers should never be targeted at children….and this Industry Code continues to require that gambling operators do not allow their logos or other promotional material to appear on any commercial merchandising which is designed for use by children. A clear example of this would be the use of logos on children’s sports’ shirts.”

Lastly, it is currently unclear when the Sponsorship Code of Conduct will (1) be published; and (2) come into force. In terms of a timeline, the White Paper simply states that the Government will:

“work with sports bodies to refine the code over the coming months.”

Given the Government’s repeated promises that the White Paper (which took nearly 30 months to be published following the call for evidence) would be published in “the coming weeks”, many will be wary regarding this statement and likely, rightly so. Not only has the Government committed itself to maintain involvement in the process of agreeing the Sponsorship Code of Conduct (which may slow it down) but the new code must also be reviewed, approved and adopted by governing bodies across “all sports”. We for one, do not envy the person responsible for overseeing such a mammoth task.

4. Our final thoughts…for now

Ultimately, we have again been delivered the message to “hurry up and wait” by the White Paper. Until the Voluntary Ban comes into force and the Sponsorship of Code of Conduct is adopted across all sports (whenever that might be), it is likely that gambling sponsorship will continue to be the subject of keen debate in the press, politics and beyond. Indeed, in recent weeks, several Premier League Clubs have been caught in the crossfire and criticised for continuing to accept front of shirt sponsorship from gambling operators, even though the Voluntary Ban does not come into force until 2025/26.

When it does come in, there are also concerns that the Voluntary Ban may not significantly reduce the visibility of gambling brands in major sports – but is this really the issue that the press and politicians are making of it? Some may argue that gambling sponsorship is simply the weapon du jour in the ongoing political warfare surrounding gambling. The White Paper, which sought to be evidence-based, concluded that the limited evidence on gambling sponsorship considered by the Government revealed that sponsorship has a limited effect on gambling behaviour. So, does it really need to be curbed and if it does, what will be the real financial impact of this on sports clubs, some of which currently derive a significant proportion of revenue from gambling sponsorship?

In our view, the key question will be whether the Sponsorship Code of Conduct can find the balance that the White Paper, and most of the industry, seeks. If it is well-considered and efficiently implemented, the Sponsorship Code of Conduct may yet prove itself to be an example of effective self-regulation. But to achieve this, sports governing bodies must strike a balance between (a) reducing the commercial practices that unduly increase the risk of exposure of gambling to children on the one hand, and (b) on the other, permitting gambling sponsorship – along with the financial injection that it brings – safely for the benefit of all levels of sport.

With credit and sincere thanks to Gemma Boore for her invaluable co-authorship.

A recent study by Djohari et al. (2021) on the visibility of gambling sponsorship in football related products marketed directly to children revealed that gambling logos were visible, largely on the front of the shirts, in 42% of the stickers 2020 Panini Premier League sticker album.